My non owner sr22 insurance blog 3171

The Definitive Guide to Sr22 Insurance - Budget Insurance - Tucson, Az

You'll find several workplaces throughout the state where you can file your SR22 kind directly, including one in,, and also. insurance. These are normally some of the you'll need to disclose on the file: Your vehicle driver's licence number, Your Social Security Number, Your birth date, Certain lorry details, like your cars and truck's Vehicle Identification Number (VIN)The beginning and end days of your automobile insurance coverage strategy, When you get an SR22 Texas insurance plan, you'll have very little time to figure out whether it is time for you to bring back the insurance protection plan. underinsured.

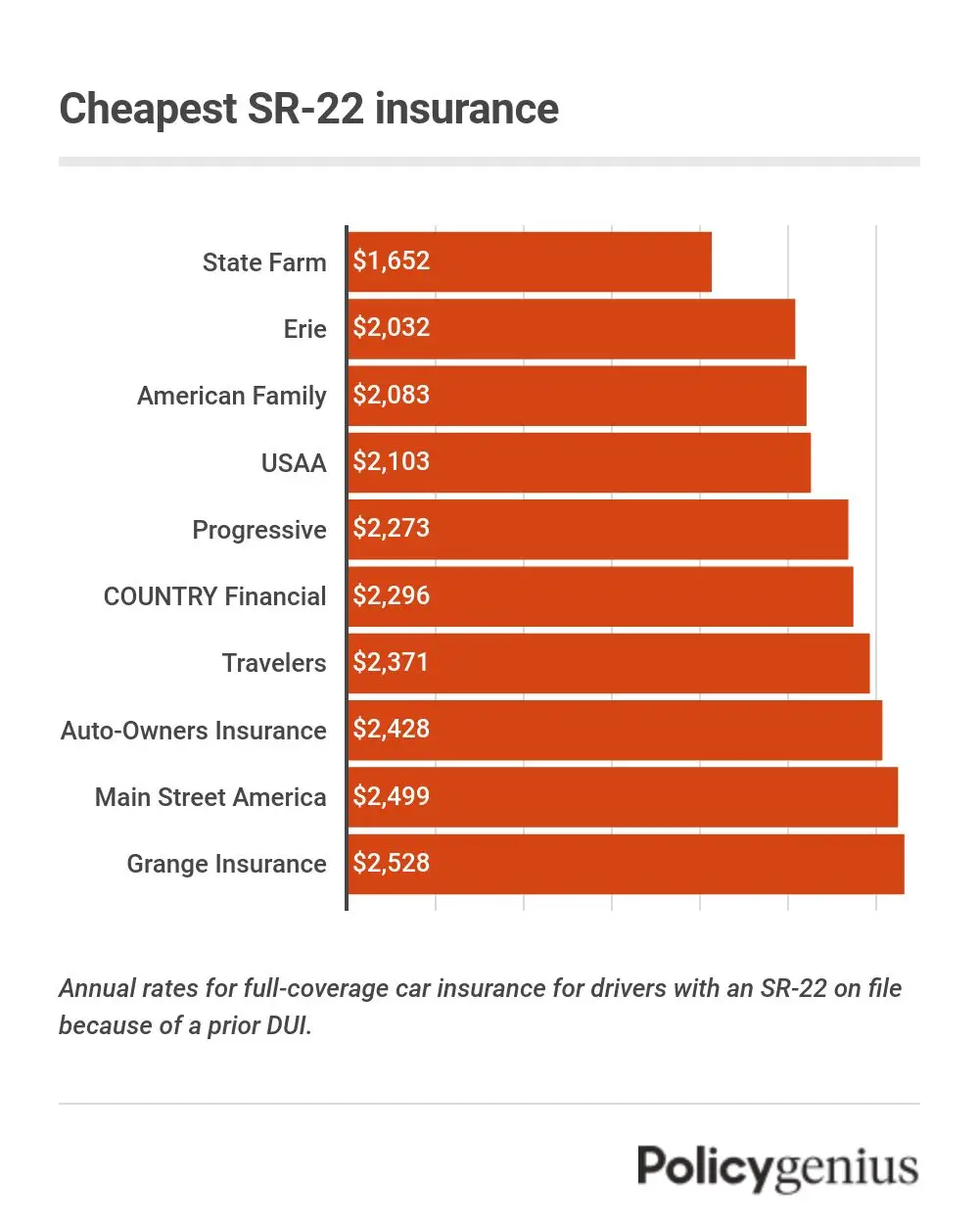

A great deal of individuals will certainly select their current insurance provider yet you might save thousands of dollars with different SR22 insurance provider (sr22 insurance). Some companies have different rates for motorists with a DWI or various other main infractions which can conserve you a lots of money. Believe about downgrading to a slower or older auto for the whole filing period.

A chauffeur who has actually kept coverage for some time as well as has been exercising very might have their insurance business run another automobile record during revival time to see if any one of their convictions have actually left. This can reduce costs throughout time (sr22 insurance). Determine if you are able to or crash for older cars.

In some cases insurance coverage plan companies lower insurance policy prices as convictions drop off. You need to make particular you aren't paying a whole lot a lot more for an insurance plan than is needed, also making use of a declaring in your policy. This may not make much feeling however in case you have a motorcycle, it will save you a good deal of money.

The Main Principles Of How Much Does Sr22 Insurance Costs

Your present firm may not be recommended of the citation that caused the required SR22 so your insurance policy coverage expenses shouldn't transform. By having responsibility insurance policy protection on a bike with the SR22, it'll meet all the state requirements as well as potentially save you plenty of cash money. Once the reinstatement specifications have currently been met, you can stop the bike plan or relocate to your initial insurance coverage business, We supply SR22 insurance policy certifications for all cities of Texas, consisting of: Houston, San Antonio, Austin, Dallas, El Paso, Ft Well Worth, Corpus Christi, Arlington, Laredo, Plano, Garland, Lubbock, Amarillo, Irving, Mc, Kinney, Grand Meadow, Brownsville, Frisco, Killeen, Mesquite, Mc, Allen, Denton, Carrollton, Waco, Abilene, Round Rock, Richardson, Pearland, Sugar Land, Odessa, The Woodlands (CDP), Lewisville, University Terminal, Tyler, Organization City, Allen, Wichita Falls, Edinburg, San Angelo, Bryan, Conroe, New Braunfels, Objective, Pharr, Longview, Baytown, Blossom Mound, Temple, Cedar Park, Missouri City, Atascocita (CDP), North Richland Hills, Georgetown, Victoria, Mansfield, Harlingen, Rowlett, San Marcos, Pflugerville, Euless, Spring (CDP), Grapevine, Port Arthur, Galveston, De, Soto and also many others.

If you understand the needs, you can obtain the proper insurance coverage,, as well as end up being a! Drive Again Soon Only With Our Cheap SR22 Insurance Coverage Texas! (Mon-Fri, 8am 5pm PST) for a or submit this kind:. ignition interlock.

Only chauffeurs who obtain stood out for a DUI will be asked to add an SR-22. SR-22 is the name of the kind your Division of Electric motor Automobiles asks you to include in your automobile insurance policy, it is not in fact a type of insurance - sr22 coverage. If you are founded guilty of Driving Intoxicated, your car insurance will obtain a lot more pricey. liability insurance.

SR22 insurance is typically called for in order to continue driving legitimately in your state - insure. You may be questioning or 'Just how much does SR22 car insurance coverage expense per month?' In this write-up, we will resolve the average price of SR22, how to get it, and also the length of time it requires to place into area.

How Much Does Sr22 Cost In Illinois - Insured Asap for Beginners

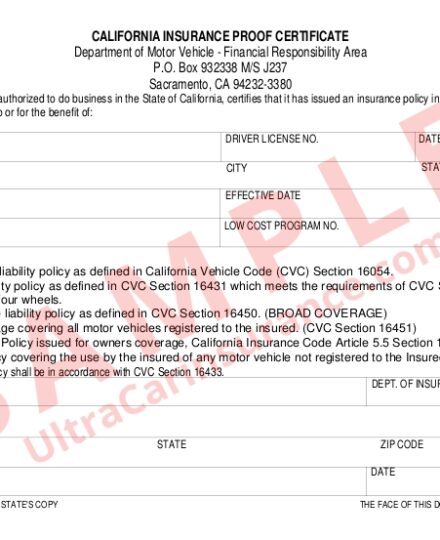

This type is required by your state to confirm you have the appropriate amount of liability protection - sr-22 insurance. It is also sometimes described as a CRF, or Certification of Financial Obligation (sr22 insurance). If you live in the state of Florida or Virginia your state might need what's referred to as a FR44 rather of a SR22.

Texas SR22 Insurance: Take a 32 hr repeat transgressor course (coverage). If you do not own a cars and truck, but require to file an SR22 with the state in order to keep your chauffeurs certificate, you can get among these really budget-friendly policies. What Does SR22 Insurance Coverage Cover? If you are required by your state to submit a SR22 kind it's likely as a result of one of the following reasons: DUI or DWIAccidents while uninsured Getting your license withdrawed or put on hold, Serious or repeat traffic offenses, Driving with a suspended permit, Requiring a difficulty license, Not paying youngster support, The SR22 will allow you to keep your permit and also enrollment and also is typically required for at least 3 years, but sometimes is needed for as much as 5 years.

Contrast ideal rates online in mins! Where & How Do You Obtain SR22 Insurance Policy? In order to obtain SR22 insurance policy, you can click on one of the links on this web page and also finish the quote kind (sr22 insurance).

Or you can contact your present insurance coverage supplier. If they do not offer the option to submit a SR22 or you aren't presently insured, then you will certainly need to discover an insurer you can buy insurance policy with that additionally has the choice to submit a SR22. insurance. If you're unsure, a fast search online can allow you know if your company can file a SR22 on your behalf. insurance coverage.

The Basic Principles Of 2022 Sr22 Insurance Colorado- Information A Plus Insurance ...

Details Needed to Obtain SR22 Coverage? The insurance coverage supplier that you get your SR22 insurance coverage through will require your motorist's permit or other recognition number. Relying on the state there may be additional details needed too. credit score. Just how Long Does it Require To Notify the DMV? Insurance provider can usually submit and also submit the SR22 types within the exact same day to your state's division of automobile, however it's feasible that it might use up to thirty days to be filed.

You will certainly need to, also if you market your vehicle. Hence the name: non-owner auto insurance policy. You are a non owner, yet still have automobile insurance policy. You can go to a company like Progressive and also purchase a Non, Owner SR22 Car Insurance Coverage. This cars and truck insurance plan will certainly offer you with liability coverage for any kind of automobile you drive, yet do not possess.

They are cheaper since the cars and truck insurer thinks you don't drive really commonly. They will submit the SR22 with your state's Division of Electric motor Vehicles and also you won't shed your drivers permit. sr22 insurance. Do not Pick Your First Quote. Compare Providers & Shop Around For the Best Price in Under 2 Minutes.

If you terminate your insurance policy protection while you are still required to have SR22 after that your firm is called for to report you to your state and also you can shed your permit (liability insurance). If you transfer to a new state that does not call for SR22 you still need to maintain your SR22 submitted with your previous state as well as hence will certainly require an insurance business that can do service in both states (motor vehicle safety).

The smart Trick of How Much Does Sr-22 Insurance Cost? - Finder.com That Nobody is Talking About

https://www.youtube.com/embed/oakDMMwNYzUWhat is the most affordable SR22 insurance policy? Some business will certainly file your SR22 insurance policy for free yet you will still be paying higher premiums because of what required you to submit a SR22 in the initial place - sr22.

What Does Non Owner Sr22 Insurance Do?

Contact among Matin Insurance Solutions professionals for a complimentary online quote. While the prices differ depending on the insurance carrier, MIS companions with firms that are "highly ranked by A.M. Best Firm." That being claimed, you need to anticipate a rise in your insurance policy premiums. Whether you have a without insurance crash, multiple traffic offenses, or a DUI, you are thought about a risky motorist, which brings about higher rates.

You must keep sufficient insurance policy for the whole time for the SR-22 to be valid. It's not necessary to submit annually; nevertheless, if your insurance is canceled for any type of reason, your permit will be put on hold once more - underinsured. You need to show constant uninterrupted coverage throughout of your called for SR-22 period for it to be legitimate.

Simply put, the SR-22 states that you are in charge of paying an optimum of $15,000 each to cover physical injury with an optimum of $30,000 per crash. You're also covered for an optimum of $5,000 in residential property damages per accident. The point of the SR-22 is to reveal financial responsibility on the occasion that you are involved in an accident.

If you're at mistake, you can be liable for paying the equilibrium. Relying on the type of lorry you drive or your assets, you may desire to take into consideration bring over the above limitations. It may be in your ideal rate of interest to preserve a much more extensive lorry policy. If you were released an SR-22 in The golden state, it is just legitimate in that state - insure.

You are required to finish every one of the essential documents for the state to which you're relocating. As soon as you meet the demands for the brand-new state, such as obtaining both suitable responsibility insurance policy as well as an SR-22 type, notify California as well as demand an SR-22 launch. It's critical that you do not have any kind of gap in protection.

MIS companions with well-known as well as reliable insurance companies who have a solid history of financial safety and commitment to consumer fulfillment. We provide you with each company's information so you can make the last, knowledgeable choice - sr22 insurance. When you're called for to show SR-22 documentation to the DMV, MIS reaches function with partnering you with the ideal insurance companies.

The Basic Principles Of What Is Sr22 Insurance?

Our insurance policy quotes are constantly free (insurance). Defense via the very best insurance companies with the most affordable rates. When Insurance Policy Business Contend, You Win!.

At fault Accidents, Depending upon the seriousness of an accident, if you have been located to blame for a collision, you may also be bought by the courts to preserve an SR-22 for a set amount of time. Multiple Offenses, Those that rack up multiple smaller sized website traffic violations in a short period of time may need to submit an SR22 (car insurance).

Just How Does SR-22 Insurance function? You might have problems if your company is not licensed in the state asking for an SR-22 certification.

Staying in a different state does not suggest your SR-22 needs vanish - deductibles. If your insurer is not accredited in the state requesting the SR-22, you will certainly have to personally send the SR-22 type keeping that state's DMV.If the process is frustrating, call the state's Division of Motor Cars or your agent for help on your state's requirements.

SR22 Insurance Coverage Expenses, Just how much an SR-22 filing expenses varies by state. Driver's typically pay around a $25 declaring charge for filing SR-22 insurance policy - sr22 coverage. This can fluctuate by state as well as the insurance service provider. An SR-22 is relatively economical as well as gets affixed to your preexisting plan. If you are dropped from your carrier or never ever had cars and truck insurance coverage, you have some choices to make when it comes to discovering the very best coverage rates.

Satisfying your state's requirements should be a concern, but you wish to locate a quote with a policy that is inexpensive. With almost every business supplying a quote online, your possibilities of locating terrific insurance coverage at an also much better rate might raise (bureau of motor vehicles). Will an SR-22 policy impact my insurance policy price? Yes.

All About Sr-22 & Insurance: What Is An Sr-22? - Progressive

Constantly be prepared for higher coverage prices after the declaring. How to Lower Cars And Truck Insurance Fees After an SR-22 plan, Your car insurance costs are bound to enhance following an SR-22 demand and also you're mosting likely to intend to locate a way to lower them. While they might never be as reduced as they were pre-SR-22, there are still some ways to make them match your budget plan much better.

Your insurance deductible is just how much you debenture in the event of a claim. The greater your deductible is, the much less your insurance coverage costs will be. When you consent to pay even more out of pocket, your insurance company will certainly have to pay less adhering to a claim. It is essential to bear in mind that once you establish your deductibles at a certain quantity, you require to ensure that you can in fact pay it adhering to an accident.

Newer models likewise often tend to be a lot more pricey to cover than decades-old automobiles. You will certainly appear to be much less of an insurability risk to your insurance policy provider. sr22.

If you are still displeased with your insurance coverage costs, ask your insurance policy agent about any discount rates you are qualified for. Representatives are well educated of the basics of all sort of discount rates you can receive. Terminating or Eliminating Your SR-22 Protection, Also if you are certain your SR-22 duration is up, calling your states Division of Motor Autos or DMV validating that is a great concept.

This, in turn, will certainly raise your vehicle insurance policy prices. SR-22 Regularly Asked Questions, Are there various types of SR-22s?

Driver - An Operator's SR22 Form is for motorists that borrow or rent out a car rather than possessing one. This might also be combined with non-owner SR-22 insurance coverage and also can supply a cheaper choice if it's hard covering the cost of an SR-22 - credit score. Operator-Owner - The Operator-Owner's SR22 Form is meant for drivers that both own an automobile but periodically, lease or obtain one more car.

The 20-Second Trick For Pennsylvania Sr-22 Insurance

How Can I Find The Most Inexpensive SR22 Insurance Policy Near Me? The finest method to discover affordable SR22 insurance near you is by shopping about and also obtaining quotes.

National insurance policy companies are not eager to provide coverage for somebody that needs SR22 insurance coverage. You might have much better good luck with neighborhood business as they commonly will cover high-risk drivers, which you will be considered with your SR22 requirement. auto insurance. Make sure to obtain SR22 quotes from every insurance coverage business you discover as well as evaluate all the SR22 policies offered on the marketplace.

Does SR-22 Insurance Coverage Cover Any Type Of Car I Drive? Yes, your SR22 insurance policy will certainly cover any type of auto you drive so long as you have owner-operator SR22 insurance. An owner-operator SR22 certificate is a sort of SR22 form that enables you to drive any kind of automobile, no matter of who has it, and also still be identified as an insured vehicle driver with a valid SR22. division of motor vehicles.

Owner SR22 insurance is an SR22 type that only enables you to drive vehicles that you possess. Non-owner SR22 insurance is the least expensive option however is just for individuals who do not own a car yet they often drive, whether it be from leasing or obtaining another person's vehicle. It relies on what your automobile ownership standing is when it comes to whether your SR22 will certainly rollover to automobiles you drive.

DUI convictions are just one of one of the most typical factors a motorist would require SR22 insurance policy. SR22s can be needed for various reasons, typically after committing a major web traffic violation. This can include things like careless driving and also driving without insurance policy. State regulations and courts will ultimately identify when you will certainly require to bring an SR22, yet it is virtually an assurance that a DUI will certainly be considered extreme enough to call for an SR22 demand.

They will certainly file your SR22 for you with the state - no-fault insurance. If your insurance provider does not offer SR22 certificates, you will require to locate a company that does and acquisition insurance policy protection with them to file the SR22 form effectively. Bear in mind that submitting an SR22 form will certainly not be the only thing called for of you complying with a DRUNK DRIVING.

8 Simple Techniques For Secrets Of Sr-22 Insurance From A San Diego Dui Attorney

An SR22 certificate is typically the primary step. What's The Distinction In Between Responsibility Insurance Policy And Also SR22 Insurance Coverage? It's tough to contrast Liability insurance policy and SR22 insurance as one does not in fact supply you with protection. SR22 insurance policy is a certification that confirms to your state you bring the proper amount of liability insurance policy coverage to legitimately be taken into consideration a driver.

Your vehicle insurance coverage firm will complete the correct SR22 documentation as well as submit it with your state's Division of Electric motor Vehicles or DMV - ignition interlock. Obtaining this SR22 certification does not offer you with insurance protection. An SR22 only informs the state that you have auto insurance policy as well as can spend for problems need to you trigger a collision.

There are two kinds of car insurance: liability insurance policy and also complete coverage. Responsibility insurance coverage just offers you with the insurance needed by the state. Full coverage vehicle insurance coverage expands security by including collision and thorough insurance coverage on top of liability insurance coverage - sr22 insurance.

By acquiring at least one of the described insurance coverage plans, you can get SR22 insurance policy. Yes, the only way SR22 insurance coverage as well as SR22 certificates differ are their names. auto insurance.

Referring to it as an SR22 certificate is much closer to its real feature. An SR22 acts as a certification of monetary duty that proves to the state that you are fulfilling the insurance policy demands mandated for all chauffeurs - liability insurance. SR22 insurance most likely got its name due to the fact that the SR22 kind can just be submitted with your vehicle insurer, as well as serves as evidence that you are bring the appropriate insurance policy protection.

After you are founded guilty of a web traffic offense as well as obtain SR22 needs, you will certainly be identified as a high-risk driver by insurance coverage carriers. Insurer are never excited to offer SR22 protection for risky drivers since they position some hazard to themselves and various other vehicle drivers. To stabilize the threat of providing you with SR22 protection, insurance policy firms will raise your costs.

10 Easy Facts About Sr-22 Insurance Shown

The even worse a violation you have, the more your rates will enhance. SR22 requirements come with an expiration day. When you can terminate your SR22 insurance, you might see a reduction in your insurance prices. vehicle insurance. A whole lot relies on your driving record. While your SR22 insurance policy may end after a number of years, your web traffic violation might remain on your record for far longer.

https://www.youtube.com/embed/CVukFXXyh80

Every chauffeur needs to obey their state's insurance coverage needs per their division of electric motor lorries, even if they do not have a cars and truck (sr22 coverage). Not owning an automobile does not allow you to stint insurance coverage. By obtaining non-owner SR22 insurance policy, you prove to your state that in spite of your absence of automobile possession, you still have insurance and also can pay for problems if you trigger a crash while driving somebody else's car.

What Is Sr22 Insurance? - Focus2move Can Be Fun For Everyone

See what you might save money on auto insurance policy, Conveniently contrast individualized rates to see just how much changing automobile insurance might save you. sr-22 insurance. If you do not get an SR-22 after a major violation, you might lose your driving benefits. sr22 coverage. Below's why you might require one and also exactly how to find the cheapest insurance coverage prices if you do.

How to obtain an SR-22 in California, Submitting an SR-22 isn't something you do on your very own - sr-22 insurance. The golden state calls for insurance providers to online report insurance info to the DMV.If you require an SR-22, ask your insurance provider to file one on your part if it will. Some insurer do not submit SR-22s - sr-22.

Our analysis found that some insurance firms use less costly insurance coverage, so it pays to go shopping about and also compare vehicle insurance coverage quotes. Our evaluation of the most inexpensive insurance providers after a DUI discovered that: California's five cheapest insurance companies boost annual minimum insurance coverage rates approximately $227. Grange Insurance policy Organization returned the most inexpensive ordinary minimal protection price after a DUI, at $723 a year or $60 a month.National General, which aims to give inexpensive insurance coverage for drivers with one DUI on their documents, had the tiniest boost in average rate out of the team, adding simply over $38 to the ordinary minimum price for motorists with a DUI, at $725 a year or $60 a month.

Because insurance firms make use of various aspects to cost rates, the most affordable insurance company before a violation most likely won't be the most inexpensive after. car insurance. Our analysis found that while Geico had the most affordable average yearly rate for a great motorist with minimal protection, after a drunk driving the price boosted by greater than 150%, pressing the firm out of the top five most affordable companies for an SR-22 in The golden state.

That Requirements SR-22 Insurance Coverage in California? Not every driver needs to file an SR-22 Form in The Golden State. They are just needed after you are convicted of a significant website traffic offense that causes you losing your motorists permit. An SR-22 Form is usually called for in The golden state after dedicating several of the adhering to infractions: Driving intoxicated (DUI)Three or even more minor driving offenses, Driving without insurance, Reckless driving, Having several traffic infractions, The golden state Minimum Insurance Obligation Demands, When buying an insurance plan, you can (and also ought to) enhance your coverage limits, but the SR-22 type is meant to prove you at the very least meet the necessary minimum amount of insurance policy.

The Buzz on Lifesafer Interlock Says High. , A Provider Of Ignition Interlock ...

However, you can opt-out of acquiring these insurance protections as long as you mention your rejection in creating. At the minimum, you need to meet the obligation insurance coverage demands in California - dui. Whatever else is optional, yet it is highly suggested that you buy full coverage for yourself and also your lorry.

It's likewise crucial to increase your protection limitations as anything not paid for by your insurance coverage provider will have to come out of your pocket (insurance). Enter your ZIP code below to watch quotes for the most affordable Vehicle Insurance policy Rates.

A court will outline the specifics of your requirement. It must likewise be noted that when your license is revoked or put on hold for an amount of time, the SR-22 insurance coverage requirement begins afterwards. You need to not allow your insurance protection gap during your SR-22 insurance need period. If you do so, your insurance provider will have to alert the California DMV.

You will certainly additionally have to go via the SR-22 declaring procedure again. Attempting to get insurance coverage after a gap in insurance coverage can be challenging, especially when you need an SR-22 policy included in your cars and truck insurance. If you vacate California throughout your SR-22 insurance period, you will certainly need to discover an insurance coverage business that does organization in both California and also the state you are preparing to relocate to.

As soon as your needed filing duration is over, you will get complimentary regime of your auto insurance coverage choices. Just How Much Does SR-22 Insurance Coverage Price in California? Insurance coverage rates can depend a lot on your conviction.

Sr22 Texas Insurance, The Cheapest! Only $7/month! for Beginners

Lots of insurance policy firms bill a declaring cost of anywhere from $25-$50. In The golden state, insurance companies can not boost your insurance coverage prices or terminate your insurance coverage plan in the middle of its term.

California car insurance policy legislations likewise forbid insurance provider from supplying great motorist policy discount rates to any individual with a drunk driving for ten years complying with the sentence. insurance group. There are other automobile insurance coverage price cuts you can still obtain in The golden state if you have a DUI, like multi-policy or packing discounts. coverage. Losing an excellent motorist policy discount rate can be damaging to your insurance coverage rates as it can be the most impactful insurance coverage discount a company provides.

A non-owner plan can provide you with the liability protection needed in The golden state and also will certainly guarantee you are shielded ought to you wind up in another web traffic case. It is likewise a more affordable kind of protection when you contrast it to typical automobile insurance policy. Yet do rule out this type of insurance coverage simply due to the fact that it is regarded fairly budget-friendly insurance coverage (car insurance).

If you are an university student living at house as well as have accessibility to your moms and dad's car, you will not qualify for a non-owner insurance policy. liability insurance. This type of policy would be optimal to obtain if you frequently rent cars and trucks. Everybody needs the proper insurance policy when behind the wheel (underinsured).

DUI Convictions in The Golden State, A drunk driving conviction is just one of the most significant traffic offenses (sr22 coverage). Even if it is your first offense, you will have increased auto insurance coverage prices along with meeting an SR-22 insurance requirement to reactivate your certificate after a DUI.Car insurance coverage is not the only area you need to fret about complying with a DUI sentence.

The Of Sr22 California - What Is It? When Do I Need It? How To Get It?

Including what is outlined in the chart below, you will certainly also have to pay a $125 registration charge and also a $15 license reprinting charge after a DUI - sr-22.

Just How Much is Full Coverage Cars And Truck Insurance in California? Nevertheless, in order to obtain the best cars and truck insurance in The golden state, aka low-cost vehicle insurance coverage that also maintains you well protected on the roadway, we suggest full coverage auto insurance, which has a typical California automobile insurance coverage price of $142 per month or $1,700 per year. underinsured.

https://www.youtube.com/embed/-dKNSXmSPMc

This is likely due to the truth that California drivers have to deal with a whole lot of website traffic (specifically in large cities with loaded rush hours).

Everything about Cheap Sr22 Insurance - Compare Quotes Here

Non-owner SR-22 insurance coverage, on the other hand, will cover you as a driver of any type of lorry you do not own, such as an auto you rent out or obtain. This way, you can comply with Illinois lawful requirements while still driving a person else's vehicle! It is worth mentioning that a non-owner SR-22 insurance coverage policy expenses considerably much less than various other plans considering that it only covers a person for obligation.

Nevertheless, a non-owner plan may not cover the vehicle owned or regularly used by the founded guilty vehicle driver. Although the danger to the vehicle you are driving remains, the higher limitations you buy for a non-owner policy to cover will certainly offer you better guarantee when it comes to a costly mishap.

Needing to file an SR-22 is no one's idea of fun. You'll pay higher car insurance premiums than a chauffeur with a clean record and you'll be limited in your option of insurance firms. However looking around for the least expensive rates can assist - underinsured. Below's what you require to understand. See what you might save money on auto insurance coverage, Easily compare customized rates to see exactly how much changing car insurance coverage could conserve you.

You could be required to have an SR-22 if: You have actually been convicted of DUI, Dui or an additional major relocating infraction. You've triggered a mishap while driving without insurance.

Not all states need an SR-22 or FR-44. If you require one, you'll discover out from your state department of motor vehicles or traffic court.

Everything about Compare Cheap Sr-22 Car Insurance Quotes Near You

When you're notified you need an SR-22, start by contacting your vehicle insurance policy business. Some insurers don't use this service, so you might need to look for a firm that does - sr-22. If you do not currently have car insurance policy, you'll possibly require to acquire a plan in order to obtain your driving privileges brought back.

Insurance policy quotes will certainly likewise differ depending on what auto insurance policy company you select. See what you could save on car insurance, Quickly contrast customized prices to see how much changing car insurance coverage might conserve you.

Area matters. As an instance, consider a driver with a current DUI, an offense that might result in an SR-22 demand. insurance companies. Nerd, Budget's 2021 price evaluation discovered that out of the country's four biggest firms that all submit an SR-22, insurance prices on average were least expensive from Progressive for 40-year-old vehicle drivers with a recent DUI.

When your demand finishes, the SR-22 doesn't automatically drop off your insurance policy. Make sure to allow your insurance coverage firm recognize you no longer require it.

Fees commonly stay high for 3 to 5 years after you've triggered a crash or had a moving infraction. If you go shopping around just after the three- and five-year marks, you might find lower premiums.

Everything about Cheapest Sr22 Insurance Arizona Az Non Owner Near Me

The regular size of time is for three years however may be as many as five. If a motorist is called for to keep an SR22, the certification has to indicate that the matching insurance coverage covers any type of cars and trucks that are registered under the chauffeur's name and all autos that the driver consistently runs.

If that exact same driver, however, has a vehicle or has normal accessibility to a cars and truck, he would require to submit a non-owners SR22 certificate. This provides the motorist insurance coverage whenever he is permitted to drive an auto not his very own. The price of an SR22 varies between insurer (insurance).

Insurance policy business that do provide SR22 coverage have a tendency to do so at a high price. SR22 insurance coverage clients also unavoidably pay higher costs for their minimal responsibility protection.

When initially bought to get an SR22, a person will likely initially call their existing auto insurance provider. As soon as that happens, it, however, alerts the supplier to the truth that a substantial occasion has actually taken place. The insurance policy firm will continue to access the DMV record to examine why the vehicle driver requires the certification.

If the policy is terminated, the motorist will be forced to find an alternative option. If the certificate is provided, the premium prices will greater than likely increase. A chauffeur is not needed to obtain an SR22 from their current car insurer. He is permitted to go shopping about for the very best option.

10 Easy Facts About Cheap Sr-22 Insurance: Cheapest Companies By State In 2022 Described

Generally, a chauffeur is called for to have an SR22 on data for three years after a permit suspension due to drunk driving. The initial certification will certainly continue to be on file with the DMV as long as either the vehicle insurance provider or the driver does not terminate the plan. There is no need to re-file annual.

After facing apprehension, court dates, and frustrating needs from the DMV, the last thing they desire to do is haggle with an insurance representative. Agencies are out there that can assist you discover the best rates for SR22 insurance policy.

Recognized as financial duty insurance coverage, this certificate confirms to the DMV and also courts that you have the monetary capacity to pay the losses that another individual experiences if you create a mishap. sr-22. If you're wondering just how a lot an SR-22 insurance coverage prices, you can obtain SR-22 insurance coverage quotes from us.

driver's license underinsured driver's license driver's license insurance

driver's license underinsured driver's license driver's license insurance

What Is the Cost of SR-22 Insurance Policy? It may be much more expensive to get obligation insurance policy if you have an SR-22 requirement.

What Are the Filing Requirements in Illinois? SR-22 paperwork is supplied straight from the insurance firm to the Department of Motor Vehicles.

More About What Is Sr22 Insurance? – Your Guide To Sr-22 ... - Way

Oxford Car Insurance policy additionally lets you pay online, for your ease. Get in touch with our insurance policy representative to have any one of your inquiries addressed regarding SR-22 coverage.

Not just will we make certain that your SR22 is submitted appropriately, we will certainly aid you obtain an SR22 insurance coverage policy that matches you flawlessly. At Accurate Insurance policy, we make the procedure easy as can be.

insurance insurance dui vehicle insurance underinsured

insurance insurance dui vehicle insurance underinsured

We'll care for the information. We understand many people have actually never ever become aware of SR-22 insurance coverage, at the very least not till they are required to lug it on their own. Therefore, we make every effort to ensure you understand what it is and also why you require it, along with just how to obtain the most effective deal on your vehicle insurance plan.

insure deductibles division of motor vehicles motor vehicle safety insure

insure deductibles division of motor vehicles motor vehicle safety insure

These actions are reserved for high-risk drivers. Those that need to get this kind of paperwork will certainly be notified by the court or state enforcing the demand (sr-22 insurance). Some circumstances that may call for a vehicle driver to file an SR-22 certificate consist of: License suspension or revoked license Driving without insurance or a valid certificate DUI, DWI, or any kind of other serious relocating offense At-fault crashes while driving without insurance coverage Repeat traffic offenses or lots of tickets in a short time duration When you litigate for these numerous offenses, the judge will certainly let you recognize if you are needed to bring SR-22 insurance.

Commonly, you will certainly be required to carry the SR-22 for a specific amount of time in order to maintain driving benefits. This differs by state, yet most states need a time period of 3 years.

Some Known Factual Statements About Insurance Navy Names The Most Affordable ... - Pr Newswire

Non Proprietor Policy - Non-owner insurance offers second responsibility coverage. A non proprietor cars and truck insurance policy is excellent for individuals that don't have a car, yet occasionally obtain a friend's or next-door neighbor's auto (credit score). An SR22 can be attached to a non-owner auto policy as well as is regularly the most affordable. Locate out even more regarding non-owner insurance here.

Every scenario calling for an SR22 is special so, get in touch with the state to validate your particular SR22 needs. Please keep in mind to maintain the SR22 for the specified quantity of time with no lapses or terminations. If the plan cancels for any factor, the insurance policy provider is legally obliged to inform the state, this is called an SR26. underinsured.

That "uh oh" moment. You've been told you need this thing called SR22 insurance policy. Do not fret, we obtained this. We're below to help you. Convenient declaring. Genuine. There's no documents. Call us for a free quote at ( 773) 202-5060 or you can obtain covered online in 2 minutes - sr22 insurance. We'll assist you get your SR22 On the Area. Obtained a letter from the State of Illinois to verify your coverage? No worry.

insure auto insurance credit score sr22 sr-22

insure auto insurance credit score sr22 sr-22

Instant SR-22 Insurance Declaring If your permit has been put on hold, withdrawed, or you have actually had a DUI, a may be called for to renew your driving benefits. With Insure right away, you can electronically submit today!.?.!! We'll look after it for you and also conserve you cash - sr22 coverage. or Call ( 773) 202-5060 Need SR22? We Make It Easy! You have concerns.

SR-22 insurance coverage!.?.!? To get a Chicago SR-22 insurance policy certification, you need a vehicle insurance plan that satisfies the state's minimum obligation coverage. When you obtain a plan with Insure on the Spot, a record is sent to the state confirming that you have protection. If your license has actually been put on hold, withdrawed, or you are considered a high risk scuba diver.

What Does North Carolina Reports: Cases Argued And Determined In The ... Mean?

insurance companies sr-22 dui credit score dui

insurance companies sr-22 dui credit score dui

Here are a couple of steps you can take to decrease your vehicle insurance coverage rates over time: Register in a motorist's enhancement course. sr22. These programs are a low-cost financial investment that you can finish online, and some states call for insurance providers to give you a price cut if you total one.

They compare this to vehicle types. In addition to the price to repair, you can reduce your rate by picking a more secure, less high-risk car - vehicle insurance. As an example, you can avoid cars and trucks that carry several of the highest possible possibilities of creating a case like the Honda Civic, Nissan Altima, as well as Toyota Camry.

If your state website traffic authority notifies you that you need the main certification of liability insurance coverage, begin searching for methods to minimize these plans that are also typically high-priced. sr-22 insurance.

https://www.youtube.com/embed/Kj5XybIDrxw

An SR-22 is not an actual "type" of insurance policy, but a form submitted with your state. This Go to the website form serves as proof your car insurance policy meets the minimal obligation insurance coverage needed by state regulation.

The smart Trick of Reinstatements - Tn.gov That Nobody is Discussing

Can I Get a Certificate in One More State If My Nevada Chauffeur's Certificate Is Put on hold? No, you can not get a license in an additional state if your Nevada driver's permit is suspended. Each state needs you to be entirely without all various other suspensions prior to you certify to obtain a valid certificate.

While you might trick a state right into issuing you one more certificate, that license isn't actually valid until you improve suspensions from an additional state. When the brand-new state learns regarding your prior suspension, you can expect to deal with fees for driving on a put on hold certificate. deductibles. 10. Exists Any Method to Stay Clear Of Needing To File Form SR-22 After a Nevada DUI? The best way to stay clear of needing to submit form SR-22 after a Nevada DUI is to avoid a DUI conviction and also permit suspension.

There may be means to strike the certificate suspension that features driving while intoxicated, yet you should act today after an arrest to protect your right to a hearing and collect the evidence that you require to defend your license. Collaborate with Our Nevada Drunk Driving Lawyer Are you dealing with a DUI arrest? Can you not afford to live without a license? Call our legal group today. insurance.

Allow's respond to all of your questions and develop a plan to resolve your lawful troubles in the very best possible way as well as maintain you when traveling (no-fault insurance).

Which Iowa Insurance Coverage Companies Offer the Cheapest SR-22 Insurance? The insurance coverage policy of a vehicle driver that needs SR-22 insurance coverage in Iowa is more costly than a common policy due to the intensity of the infraction. A typical policy with state minimum protection for a motorist with an SR-22 type because of drunk driving is $587 per year typically (sr22).

When looking for low-cost SR-22 insurance in Iowa, you will certainly have to consider your alternatives - sr22. Travelers, on the various other hand, is the most pricey SR-22 insurance firm in this state, at an average of $1,120 per year.

Best Cheap Sr-22 Insurance Rates In California for Dummies

Declare SR-22 insurance coverage includes an one-time fee that sets you back around $25 - sr-22 insurance. High-risk traffic infractions will withdraw your qualification for good vehicle driver price cuts, making SR-22 insurance policy a lot more pricey. The price of insurance policy for drivers that require to have an SR-22 form varies depending upon the seriousness of the violation.

bureau of motor vehicles auto insurance insurance coverage auto insurance coverage

bureau of motor vehicles auto insurance insurance coverage auto insurance coverage

Your cars and truck insurance coverage provider will certainly file the SR-22 kind on your behalf, but you need to check with your insurance firm to see if it issues SR-22 forms. If it does not, you will have to find a provider that does.

Although rates will differ, they will not be as high as a policy for motorists who require to have an SR-22. The intensity of your sentence will establish how much time you will certainly require SR-22 insurance in Iowa. Most of the times, it is 2 years after the reinstatement of your license.

Risky chauffeurs are required to get an SR-22. Due to the fact that of this danger factor, some insurance companies may not cover you. Those that supply insurance policy protection for chauffeurs with SR-22 in Iowa will likely increase your premium prices. Contrast Car Insurance Coverage Fees, Ensure you're getting the ideal rate for your automobile insurance.

In Iowa, the typical cost of non-owner auto insurance policy is $387 per year (division of motor vehicles). Keep in mind that this rate can alter depending on the automobile insurance coverage business.

Increase ALLWhat is an SR-22 in Iowa? An SR-22 in Iowa is a demand for a motorist committing a serious driving infraction, such as multiple web traffic offenses or DUI. It is not a different policy but an extra form to prove that you have enough protection to comply with the state minimum need.

Rumored Buzz on How Long Does A Dwi Negatively Affect Your Car Insurance ...

Which company in Iowa is the least expensive for SR-22 insurance? State Farm has the cheapest SR-22 insurance coverage in Iowa.

These flat fees tend to be affordable, though as low as $15 oftentimes. The real price of an SR-22 in Florida or in any other state comes from the greater automobile insurance prices you might pay because of the driving violation that triggered the SR-22 filing (sr-22). This is also more accurate when it concerns the price of FR-44 insurance coverage since it is tied to a DUI sentence.

If that motorist triggers a mishap, however, his average cars and truck insurance coverage rate jumps to $2,699 each year. That's $768 per year, or 40%, greater than what he would pay with a clean document. With a DUI on his document, our sample vehicle driver paid approximately $2,821 per year for a full-coverage auto insurance plan $890 per year greater than what a motorist with a tidy document pays.

Where can I obtain low-cost SR-22 insurance coverage in Florida? GEICO provides the most inexpensive SR-22 insurance policy in Florida, according to our information. It also uses the most affordable FR-44 insurance coverage in the state. This is based upon GEICO supplying our sample driver with a DUI or an at-fault mishap on his document the most inexpensive auto insurance prices of the firms we evaluated.

Your rates might differ. In this case, the ordinary yearly quote our example driver with an at-fault crash obtained from GEICO was $742 for a full-coverage plan. department of motor vehicles. That's virtually $1,000 each year more affordable than the ordinary quote we obtained from State Ranch, and also a massive $3,721 less expensive than Allstate's ordinary quote.

no-fault insurance underinsured no-fault insurance division of motor vehicles underinsured

no-fault insurance underinsured no-fault insurance division of motor vehicles underinsured

Florida's minimum automobile insurance policy needs are: An SR-22 shows that your vehicle insurance plan meets these minimum needs (bureau of motor vehicles). How long is SR-22 required in Florida? You will need to have an SR-22 on documents with the state for 3 years. That is just how lengthy most states call for high-risk motorists to file SR-22s, though some require it for longer.

Non-compliance Suspension - Ohio Bmv - Questions

insurance coverage sr22 coverage insurance coverage no-fault insurance insure

insurance coverage sr22 coverage insurance coverage no-fault insurance insure

, ends or is canceled throughout this duration, your insurer will alert the state and you will certainly have to reactivate the SR-22 filing process. What are the FR-44 insurance policy demands in Florida?

That said, for how long you require to maintain an FR-44 submitted with the state depends on your certain circumstance. What is the difference in between SR-22 and also FR-44 in Florida? The distinction between SR-22 and also FR-44 in Florida is that the state requires you to submit an FR-44 if you're founded guilty of driving intoxicated, while it needs you to file an SR-22 for various other offenses, like reckless driving or triggering a mishap without insurance policy.

LLC has actually made every effort to ensure that the details on this site is proper, however we can not guarantee that it is free of errors, errors, or omissions. All web content and also services given on or with this website are supplied "as is" and "as available" for use.

DUIs and also Duis are the most significant violations that cause motorists to end up being risky. If you get a DRUNK DRIVING, you'll more than likely be called for to lug an SR-22. The moment period you have to carry the SR-22 varies per state, however you'll generally need to bring it for three years after your DUI.

If you can not drive, then do you still require an SR-22? Whether or not you have a valid certificate or a vehicle, you require to lug an SR-22 if determined by the state or court. An SR-22 simply confirms that you lug a car insurance plan for the minimum amount of coverage needed by the state - deductibles.

Insurance policy firms may drop you after a DUI or they might just charge you greater costs, despite how much time you have actually been guaranteed at the firm. Make sure to go shopping amongst insurance policy business that routinely insure risky drivers. Any violation or time out in your SR-22 can cause an insurance provider dropping you in addition to effects from the state that purchased the SR-22.

Not known Details About What Is Sr-22 Insurance And Who Needs It? - Credit Karma

In Louisiana, it is versus the regulation to Drive While Drunk (DWI). A conviction for a Louisiana drunk driving can lead to the suspension of your driving benefits for a year or even more on your initial infraction. In order to restore your driving advantages, you might be required to complete a vehicle driver education training course, pay significant penalties of $100.

It has to be completed completely and also validated by your insurance coverage representative or insurance provider - vehicle insurance. Do not send your insurance plan. Send protection in the type of a qualified check (no individual checks), or a certificate of deposit, duly assigned to the Division in the quantity provided in the letter.

The release needs to have the date of the mishap as well as the names of all celebrations entailed. Submit a notarized conditional launch of obligation authorized on your own and the other event(s) or their insurance policy business showing that you are making settlements for damages as a result of this mishap. The conditional release should consist of the day of the crash and also the names of all the events entailed. insurance.

department of motor vehicles sr-22 sr-22 insurance auto insurance insurance companies

department of motor vehicles sr-22 sr-22 insurance auto insurance insurance companies

NOTE: Never send money through the mail. You will require to speak to an insurance provider authorized to create policies in the State of Wyoming and pay for an SR22 (insurance companies). SR22 is a kind informing this Division that the chauffeur with the demand has a valid insurance plan. The SR22 is normally sent to Chauffeur Services electronically within 24 72 hours after acquisition.

Please note: you may still owe a reinstatement cost! Citations are paid to the court, for court call information see the Wyoming Judicial Branch internet site - liability insurance.

If 5 years pass from the date of suspension before you renew your privileges, after that the SR-22 would not be required. If the SR-22 is cancelled before the called for time and also a new kind not filed, your driving privileges will certainly be suspended.

The Only Guide for For How Long Do You Helpful site Need Sr22 Insurance In Ohio?

AN SR-22 declaring offers a guarantee to the Missouri Department of Income MVDL that an insurer has provided at least minimum liability insurance coverage for the person submitting the filing; and that the insurance coverage firm will inform the Missouri Secretary of State ought to the insurance policy ever lapse for any kind of reason.

While these are the minimal amounts of liability insurance policy, all insurance service providers provide the alternative to purchase higher limits: $25,000 physical injury per mishap $50,000 physical injury obligation for all injuries in a crash, and also $10,000 in building damages in one crash Typically for one to 3 years, depending on the reason why you are required to have SR-22 insurance coverage.

https://www.youtube.com/embed/twMFTHlAIvg

This is called a non-owners plan. If you do not have a lorry you can still obtain SR-22 insurance policy coverage under a non-owner's insurance coverage (auto insurance). This kind of policy is not linked to a details lorry, it can be utilized for any vehicle the SR-22 owner uses. If you possess an automobile you have to purchase a proprietor's policy as well as have your car linked to your SR-22 protection.